Users are now spending more and more time on their mobile apps, and not just for entertainment. Fintech and banking applications are seeing a significant increase in traffic, and top investment apps are getting more popular than mobile games. If you want to develop your own product and need inspiration, take a look at our A-Z guide to investment applications. Here, we will unwrap everything from key features to the development process and monetization ideas.

Market Overview

The fintech market is experiencing explosive growth. The experts expect its global value to reach $324 billion by 2026, and investment apps take a decent share of the market with a global value of around $9 billion. Surveys show that more than half of millennials prefer to manage their finances through a mobile app. And as for the Gen Zs, they doubled their time on investment apps during the pandemic years. And it looks like this trend is not going anywhere.

The industry is highly competitive, though, with new players entering the market regularly and established players constantly improving their products. So “just an app” won’t fly anymore. The digital and mobile-first investing trend has increased demand for innovative and user-friendly investment applications. So now, there is a wealth of opportunities for entrepreneurs looking to enter the market with a top-notch product after they hire android application developer.

Types of Investment Apps

The investment app market is diverse and offers various applications to suit different investment goals and preferences. Here are several of the most popular types of applications for investing:

Brokerages

Brokerage apps allow individuals to trade stocks, bonds, and other securities. These apps offer a range of investment options, from individual stocks to mutual funds, and allow for real-time trading and market data. Brokerage applications typically need the user to have investment knowledge and the ability to make informed investment decisions. Great examples of brokerage apps are Robinhood and Fidelity Investments, which allow users to buy stocks and ETFs.

Robo-advisors

Robo-advisor apps are designed for those who want to invest their money but may not have the knowledge or expertise to make informed investment decisions. These apps use algorithms to analyze market data and make investment recommendations based on the user’s risk tolerance and investment goals. The user can then decide whether to accept the recommendations, making robo-advisors an excellent option for beginner investors. Robo-advisors like Wealthfront and Betterment can help in buying stock funds, as well as in creating a portfolio on your behalf.

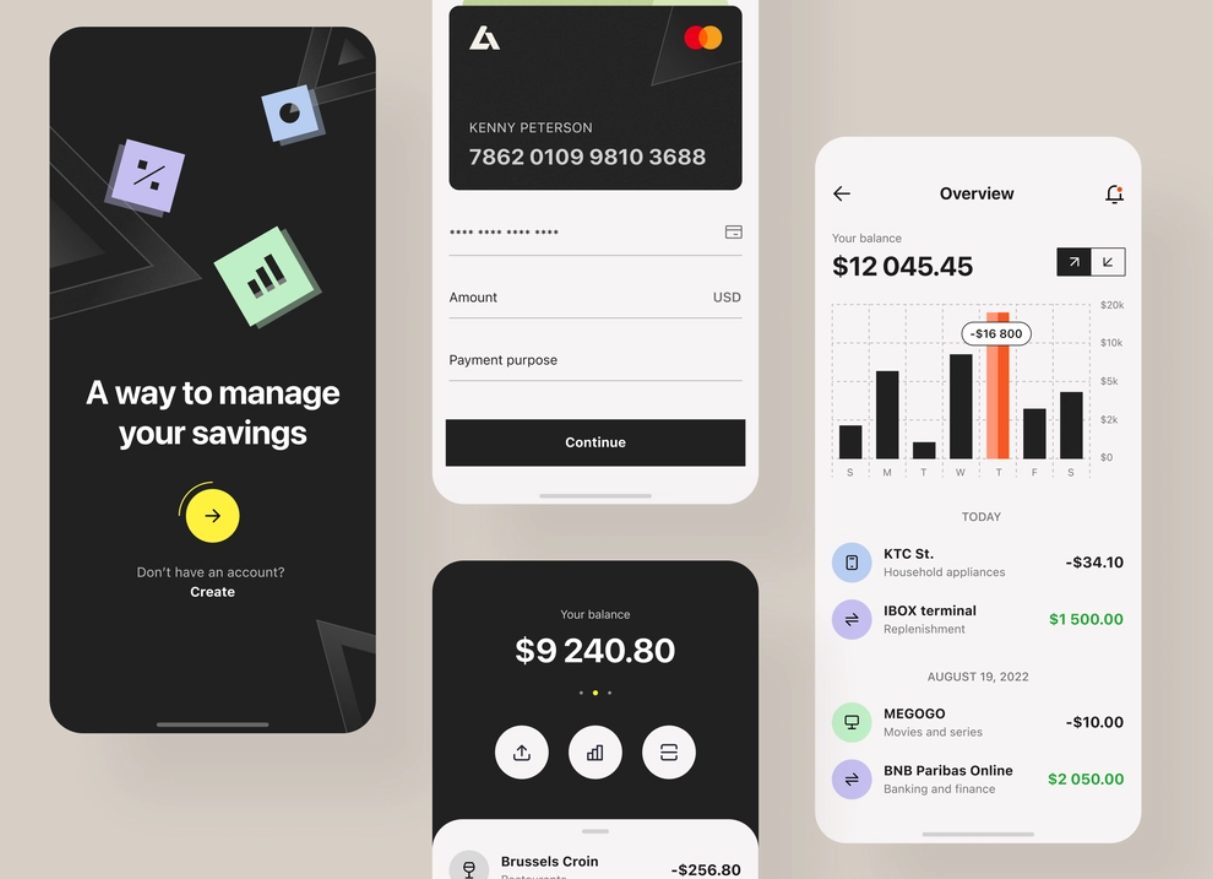

Banking apps

Besides the standard features like account details and transactions, banking applications often include investment features, allowing users to manage their finances and investments in one place. Banking apps are a good choice for individuals who want to keep their investment portfolio simple and are looking for a one-stop shop for their finances. Arineo from Fireart Studio stands out among the banking app options with the best user experience and various features.

Investment platforms

Investment platforms provide a range of investment options, from individual bonds and stocks to mutual funds. These applications are designed for individuals looking for a more hands-on approach to investing and want a more comprehensive range of investment options. Investment platforms may offer real-time market data, trading tools, and educational resources to help users make informed investment decisions.

Investure, an investment dashboard app, is another excellent example from Fireart. It is an intuitive platform that does not require deep learning, with the interface being clear and simple even for beginners.

Exchange-traded funds app

ETF apps specialize in exchange-traded funds (ETFs), the investment type that pools money from multiple investors to buy a portfolio of stocks, bonds, and other securities. ETFs provide a simple and cost-effective way to diversify an investment portfolio, and investors can sell and buy them on a stock exchange just like individual stocks. ETF apps are a good choice for individuals looking for a low-cost, diversified investment option.

Top 4 Investment Mobile Apps Case Studies

We’ve got several interesting financial and investment app websites in the Fireart collection. Check them out if you need inspiration or want to see what we can do as a team of professional designers and developers.

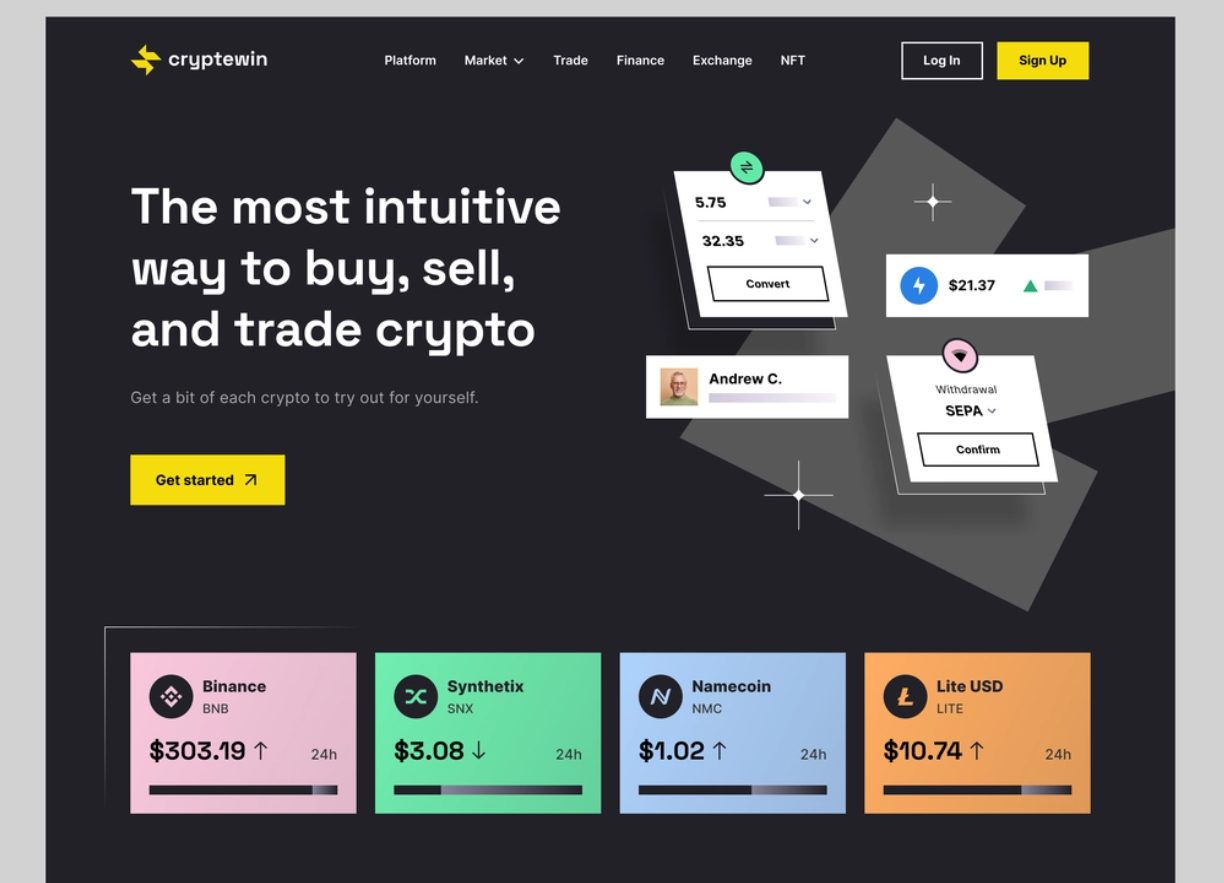

1. Cryptewin

Cryptewin is a traded company operating a platform for cryptocurrency exchange. It provides users with the most accessible and secure platform to buy, sell, trade, and earn cryptocurrencies.

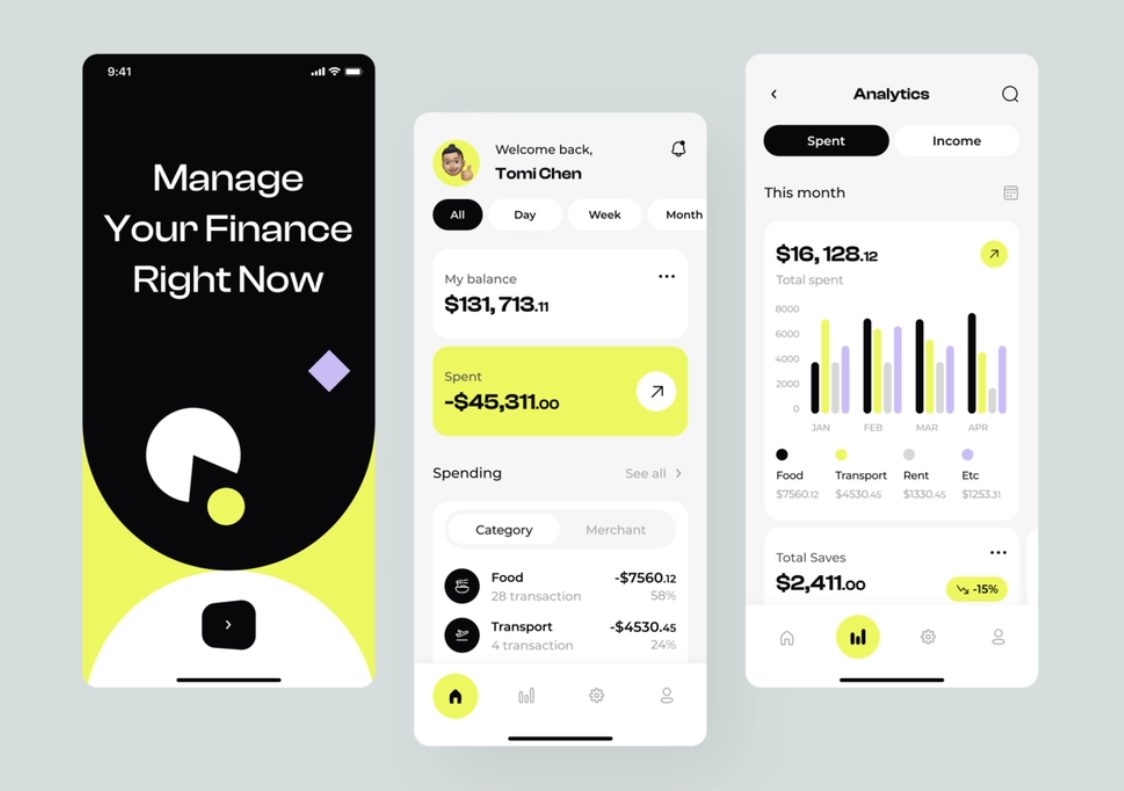

2. Rippic

Rippic is a financial app concept developed to help users manage their income and expenses easily and transparently.

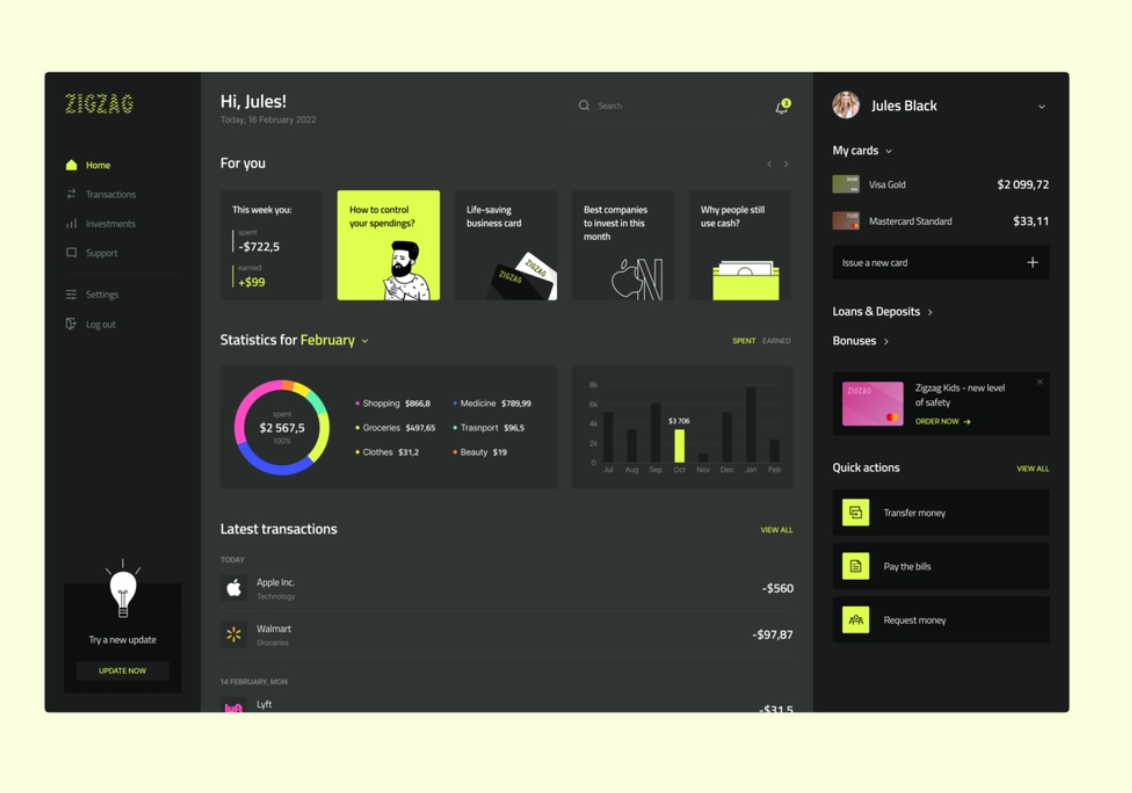

3. Zigzag

Digital banking is the future, it’s a fact. People don’t want to waste hours in queues and traffic jams just to get to the bank, when anything can be done online. With Zigzag, users can track transactions, get insights of their income & expenses, send wires, and so on.

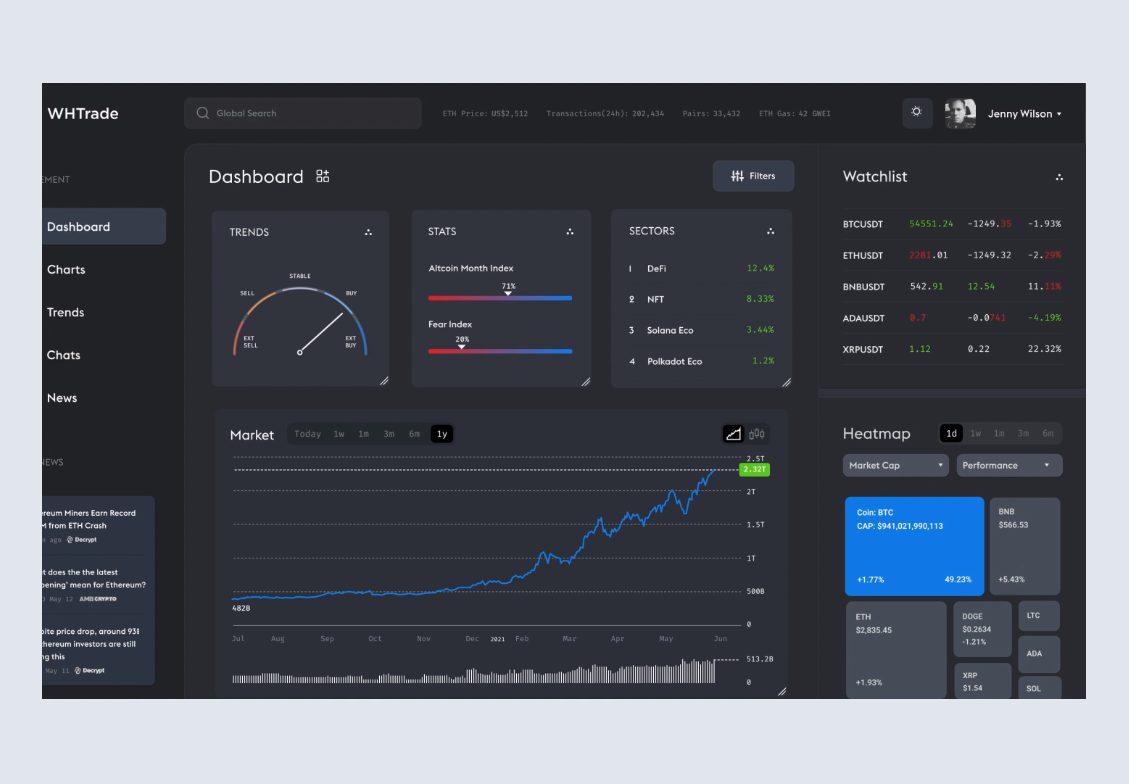

4.WHTrade

WHTrade is an analytical and trading platform. Along with a variety of other benefits, its main attraction is flexibility. Users can change and adjust widgets, switch between dark and light modes, and so on. And with such a level of personalization, the platform still looks clear and straightforward.

What Is A Good Investment App: Key Features

As you consider creating an investment application, you must answer several questions first. What are the best investment apps? What do they have in common? Which features do they offer to users?

With so many apps available in the market, it can be overwhelming to determine which features are essential and which are just nice-to-haves. In this section, we will dive into the key elements that make a great investment app. By understanding these features, you can ensure that your investment app stands out in a crowded market and provides the seamless, efficient investment experience that users want.

The key features of financial investment apps might include the following:

- Signup and login. To start with, there should be several easy and secure ways to create an account and log in to the existing one. Make sure to include two-factor and/or biometric authentication.

- Investor portfolio and money management tools. Users should be able to edit their personal and banking details and manage their investment portfolios. There should be a dashboard with all the current assets, search, and sorting features.

- Online transactions. Obviously, there should be a way to deposit and withdraw funds, so you’ll need an integration with bank accounts and a protected payment gateway.

- Statistics. The investment process is impossible without analytics, so your users will need detailed statistics on their transactions, profits, and losses. It could be real-time analytics, daily/weekly/monthly reports, etc.

- Notifications. Let your users get notified about any events in their account, asset price rise/fall, promotions, and whatever else you believe to be necessary. Make sure notifications are customizable — some people would prefer to turn them off entirely or reduce the number of pushes on their screens.

- Support. You can add a chatbot or human customer support option available through several ways of communication.

When you are done with critical features, you can also think of other ways to improve your app. Advanced features might include but are not limited to dividend reinvestment, tax monitoring, newsfeed, robo-advisors, cryptocurrency support, and so on.

How to Create an Investment App In 10 Steps

Creating an investment app can be a complex and challenging process, but with careful planning and execution, and the right team, it can be rewarding and profitable. Here are the steps you’ll need to take from point zero to the final project:

Determine target audience and user needs

The first step in creating an investment app is determining your target audience and their needs. It will help you decide what features are essential for your app and what user experience you want to provide. To get a deeper understanding of your target audience, you should conduct market research and gather feedback from focus groups.

Investment apps can target several market segments, including individual investors, institutions, and family offices. Each segment has its unique features and requirements, and investment apps must cater to their needs to succeed. For example, individual investors may be looking for a simple and straightforward investment platform, while institutions may require more advanced features such as portfolio management tools, performance tracking, and customized reporting. Family offices may have different needs, such as private wealth management and estate planning services. To cater to these needs, investment apps must offer a variety of features and functionalities that meet the requirements of each market segment.

Research competitors and market trends

To ensure the future success of your investment app, you need to conduct comprehensive research on your competitors and market trends. It will give you valuable insights into the current state of the investment app market, as well as an understanding of what features are in high demand among users. You should carefully evaluate the products of your competitors, paying close attention to their target audience, monetization strategies, and user feedback. Additionally, it’s important to stay up to date on the latest investment industry trends and understand the current and future demands of your target audience. By doing it, you will be able to stay ahead of the competition and offer a unique value proposition to your users.

Comply with regulations

Any fintech app requires a lot of compliance details that you’ll want to cover as early as possible. One of the key regulations is KYC (Know Your Customer), which requires companies to verify the identity of their customers. It is important to prevent terrorism financing and other financial crimes. Investment apps also need to comply with Anti-Money Laundering (AML) laws, which regulate the reporting of suspicious transactions and transactions over a certain threshold.

You also need to make sure your app is compliant with GDPR, as you’ll be collecting and processing a lot of users’ data and other legal rules that depend on your location.

Failing to comply with regulations could result in costly fines, legal penalties, damage to your reputation, and loss of user trust. At this point, it might be reasonable to consult a legal professional to ensure that your app is fully compliant.

Choose the right technology stack and development team

Once you have determined your target audience and done your market research, it is time to choose the right technology stack and development team. It’s one of the most crucial steps, as the quality of your app will depend solely on the proficiency of the team working on it. The experience and location of your development team can also significantly influence the development cost.

It’s important to vet potential development teams carefully and to choose a technology stack that is secure, scalable, and able to support the features that you have defined, whether it’s an investment app for Android, iOS, or a cross-platform one.

Define the app features and functionalities

At this point, you will need to define the features and functionalities of your investment app. It includes determining which financial instruments you will offer, what investment strategies you will support, and what type of user experience you want to provide. We’ve already covered the key feature ideas above, but you might have your own concepts you wish to implement.

You need to strike a balance between offering enough features to meet the needs of your target audience and not overwhelming them with too many options. Additionally, it’s essential to prioritize the development of features that are essential to the app’s core functionality while considering future features that you can add in future updates.

Design the app interface

The user interface is the real face of your app, and it plays a significant role in determining the overall user experience. Great UX and UI are vital for the app’s quality, so hiring the right design team is no less important than the development one.

The design team will work closely with you to understand your requirements and create a design that meets all the needs of your target audience. The design process typically involves creating wireframes, mockups, and prototypes and testing them with users to ensure that the final design meets their needs.

Once the design is ready, the design team will work to create the visual elements and assets for the app, including the graphics, color palette, typography, and icons.

Develop the app

Now, it’s time to start developing the app. The development team will be responsible for implementing the features and functionalities you have defined while ensuring that the app integrates seamlessly with stock market APIs and financial institutions.

The development process typically involves writing code, testing and debugging, and iterating on the design and features until they are fully functional. The development team should also ensure that the app is scalable, secure, and can handle a large volume of users.

It’s important to work closely with the development team throughout the process to ensure that the app meets your expectations and requirements. You should also consider using agile development methodologies to ensure that the development process is transparent, collaborative, and iterative.

Test the app and refine features

Once you’re done with the development, it’s time to test the application thoroughly to ensure that it functions as expected and meets the needs of the target audience. This step is critical in the app-building process, as it can identify any issues or bugs that must be fixed before the launch.

Testing can be done through various methods, such as user testing, internal testing, and quality assurance testing. During this stage, it’s important to gather user feedback and make any necessary improvements to the app, whether it’s fixing bugs, adding new features, or optimizing the user experience.

It’s also important to test the app for security vulnerabilities and ensure that it meets the industry standards for data privacy and security.

Launch the app and promote it

The launch is an exciting moment, as it means that your investment app is now available for users to download and start using. Yet, it’s crucial to ensure that the launch is well-promoted to your target audience so that they know of the app and its benefits.

You can use various marketing channels such as social media, online advertising, PPC, and email marketing. You’ll also need to create a solid launch plan with a timeline of events, promotions, and activities leading up to the launch.

You should also track your results to determine what is already working and what needs to be improved so that you can optimize your marketing and promotion efforts and reach your target audience effectively.

Provide customer support and maintenance

Customer support and app maintenance are ongoing processes. To ensure the longevity and success of your investment app, you’ll need to provide prompt and helpful responses to customer inquiries and resolve any technical issues that may arise. Regular updates and maintenance can also help to keep the app functioning smoothly and to address any security vulnerabilities. With top-notch customer support, you can build a loyal user base and ensure that your investment app remains a trusted and reliable tool for managing investments.

Investment App: Cost of Development

The development cost varies from project to project and depends on many factors, including the number and complexity of features and your team’s location. The development of a simple mobile application for investment with a basic set of functions may start at the cost of $10,000, reaching $30,000 as it gets more complex. Still, the final price can only be decided after discussing and understanding the tasks and preliminary project assessment. All steps included, the cost of creating an investment app with minimum viable features will range from $50,000 to $100,000.

How Can You Earn As An Investment App Owner?

Monetization is a critical aspect of any business, and investment apps are no exception. You are not investing in a mobile app just for fun, so make sure you know how you will earn money from your app. Several monetization strategies can be used to generate revenue from an investment app. Here are a few popular options:

- Commission-based revenue. It is a common monetization strategy in brokerage apps. Investment apps can charge a commission on trades made through their platform, adding up to a large amount of revenue over time. For example, Robinhood charges zero commission on trades made on the platform, while other brokerages charge a fee ranging from $4.95 to $6.95 per trade.

- Premium features. Another monetization strategy is to offer premium features for a fee. For example, a robo-advisor app may offer advanced portfolio management features for a monthly or annual fee. It can be a perfect way to generate revenue from users looking for a more hands-on investment experience.

- Advertising. Investment apps can also generate revenue by displaying advertisements within their platform. It is a good option for investment apps that have a large user base and can attract advertisers interested in reaching a financial audience.

- Subscription-based model. This monetization strategy involves charging users a recurring fee for access to the app. For example, a robo-advisor app may charge a monthly fee for access to investment advice and portfolio management services.

It is vital to note that the best monetization strategy will vary depending on the type of investment app and the target market. Entrepreneurs and businesses looking to enter the investment app market should consider which monetization strategy will work best for their specific needs.

Turning Your Investment App Concept Into Reality With Fireart

Developing your own investment accounting application can be expensive and time-consuming. But if you manage to combine great design, useful features, and a competent launch, the app will quickly pay off and bring good profits.

At Fireart Studio, we offer comprehensive mobile app development and design services and can help guide you through the entire process of creating an investment app. Our team of experts can work with you to ensure that your app meets all of your requirements and that it is delivered on time and within budget. We are always here to answer your questions, dispel your doubts, and share ideas — just drop us a line.