How to Pitch a Product Idea to Investors [The Founder’s Tips]

The article by Dima Venglinski, Founder and CEO of Fireart Studio

Follow these proven strategies to create a successful investment pitch deck – with recommendations on how to avoid missteps when introducing an idea to a funding organization or angel investor.

Every great product starts with a brilliant idea – and searching for people, resources and funds to implement it. How you’ll fund the business venture is the first question that arises once you come up with an idea. You can acquire investments by pitching your project to funding organizations or angel investors.

I know how it feels to stand in front of a group of investors, wondering if they like your product, if they like you, and (most importantly) if they will fund your startup. That’s why I’m going to share my insights on creating a successful investment pitch deck to help you avoid pitfalls and get funding.

11 Steps to Create a Successful Pitch Deck

1. Write a Concise and Appealing Project Description

The second slide in your product presentation must say about WHAT is your product (the first one usually features a project name). The project description should tell about the essence of your product, its ideas, and the mission in a nutshell. Don’t forget about the rule of the sweet wrapper. It’s advisable to pack your product description in a well-designed, minimalist, and concise format.

When creating it, imagine that you’re writing the ad copy for your product or crafting a promotional banner. What does work best in advertising? Conciseness, clarity, eye-catchiness, and creativity. Try to implement it all in your project description. It might be challenging to include everything in a few paragraphs on a single slide, but you should try to do it at least.

2. Clearly Formulate a Problem

The next slide usually familiarizes with the problems your target audience encounters in everyday life. Try to step into your customer’s shoes to understand their pain points better and formulate the problem more clearly. Is it a “problem” for them at all? The correct problem definition is half of the product’s success and can help you find a perfect product-market-fit. It shows WHY people need your product.

3. Introduce Your Product as a Solution

At this step, concisely describe HOW your product solves a customer problem and makes people’s life easier. It’s one of the most important parts of a presentation. Introduce your product as a perfect problem-solver with additional advantages that haven’t yet been offered by competitors. This part of your messaging should address the problem described in a previous slide.

4. Show The Results of Your Target Market Research

The third slide commonly shows the results of the preliminary target market research. It includes three main clusters of data about the total addressable market, including information about the Total Available Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM). This few data allow investors to see if your project matches their interests at a glance.

- Total Available Market (TAM). It’s the number of businesses (in case of a B2B startup) or people (in case of a B2C startup) your product is targeting. In other words, it’s the total market demand for your product.

- Serviceable Available Market (SAM). It is the segment of the overall available market targeted by your product within your geographical reach.

- Serviceable Obtainable Market (SOM). It’s the portion of a serviceable obtainable market that you can capture.

The process. Investors make the first conclusions on the product idea by estimating early target market analytics provided by the product creator. Usually, it’s an area of evaluation made by junior data analytics specialists. At this stage, they just “trust” your data, and their decision on your project approval is based on it. It helps them determine whether the project suits the vertical and funding round they usually invest. Funding rounds typically begin with an initial pre-seed or seed round, which then progresses from Series A to B, C, and beyond.

If the project is approved, all the data are exposed to detailed research and verification conducted by senior investment analytics experts. If your startup is at the later stages, investors will also pay particular attention to the project’s exposure, revenue, and return-on-investment rates.

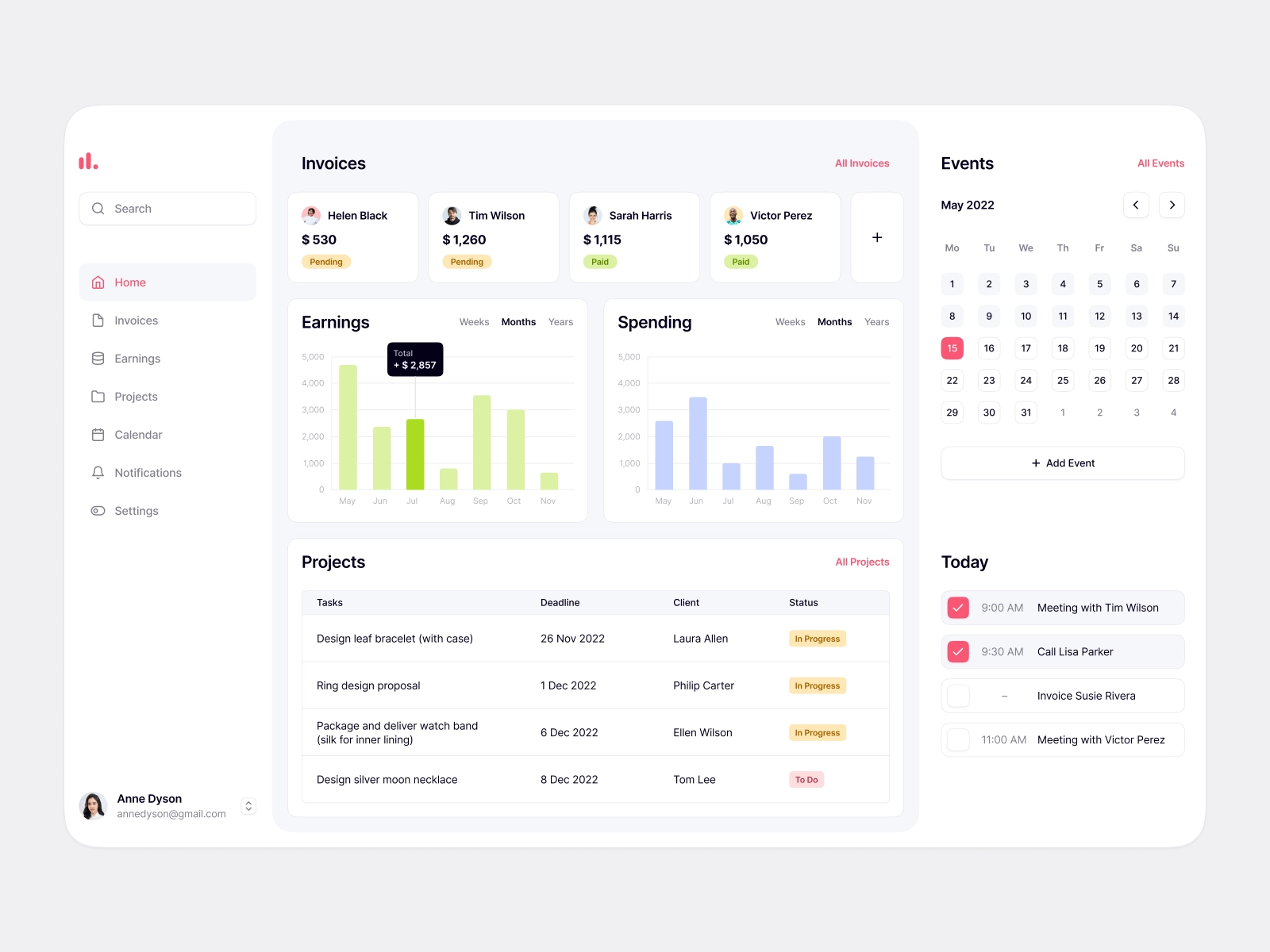

5. Build a Business Model Canvas

A business model outlines how you’re going to make money. This slide is the subject of the biggest interest for investors, so be sure you prepared it well. It includes information about the key partners, key resources, value proposition, marketing channels, revenue streams, customer segments, relationships with customers, and the cost structure. This little information is enough for them to see that you’ve conducted detailed preliminary research and have a plan on how to implement your project.

6. Include a Competition Map & Showcase Advantages

It’s recommended to include a competition map even if your product is ultra-innovative and doesn’t have many competitors in the niche. Why is it so crucial to mention your competitors? Because a product that has no competitors evokes shades of distrust and a lot of additional questions.

Investors may start wondering why your product doesn’t have competitors. Were similar projects closed for some unobvious reasons that might be revealed only at the later development phases? Wasn’t, maybe, a target audience ready to pay for a similar product? Or did the product have a poor market-fit, and people simply didn’t need it? A competition map helps avoid lots of tricky questions on the investors’ side. Even if your product is innovative, it has competitors regarding its separate features at least. So, you can mention these companies in a competition map.

7. Create a Customer Profile

The customer profile lets investors know that you clearly understand whom you target. The customer profile is a brief description of your ideal consumer and includes information about gender, age, nationality, interests, preferences, purchasing behavior, etc. The narrower your target audience is, the more sales it usually brings. Micro-targeting allows you to run very specific, relevant, and effective campaigns.

Keep in mind that there are two types of target audiences: people who buy products and those who participate in a purchasing process. For example, if you sell shirts for men, you should consider that your product is more often purchased by women, although it’s initially intended for men. Consequently, it’s advisable to target your advertising and other marketing campaigns at both audiences, men and women.

8. Showcase Your Roadmap

The roadmap adds more credibility to your project. You can include early milestones you’ve already done together with a team to prove that you’re going to complete everything timely in the future as well. The roadmap also shows that you have a clear plan of how to move your product creation forward. It confirms that you have already estimated how much funds you need to accomplish each stage of a project.

9. Describe Customer Acquisition Models

Research and define customer acquisition strategies that will work best for your project. Is it worth focusing on online or offline channels? Would it be better to invest in brand awareness on social media or invest in paid search traffic on Google Ads? Or probably should you hire a B2B sales manager? Determine your way to win new customers and share your thoughts with investors.

10. Introduce Your Team

At the very beginning, you have nothing but the idea and people to help you implement it. That’s why when considering startups in the early phases, investors pay particular attention to the team, not to the product itself as it might be expected. First of all, they invest in people involved in your project. Investors try to estimate your team’s potential, its professionalism, and capability to build something great together.

A significant factor influencing the investor’s decision is your ability to make people fall in love with your ideas. That’s why live meetings, video-calls, and presentations at the conferences are preferred ways of introducing your startup to investors. They convert success five times better than emails or any other type of online communication.

11. Mention Your Financials

It’s advisable to have a slide with your financials. One mistake founders often make is being vague when it’s time to talk about money. Including a slide with financials, you help both investors and yourself. It allows you to save time on communicating with investors who aren’t ready to pay such money, and it enables investors to quickly decide whether they should proceed with your startup.

Three Personal Tips for Creating a Successful Product Pitch

Say only the truth about your project estimates in the product presentation

It’s over-important to be realistic and provide trustworthy project estimates, market analytics, or any other predictions. Keep in mind that it’s better not to show things in a positive light if they aren’t in reality. Funding organizations and angel investors are very smart people. Even after your startup idea is accepted, all the data will be thoroughly checked during the due diligence process. Investment analytics will research information about you as an expert and entrepreneur. They might even check information on your social media profiles or enquire feedback from your former employers.

Don’t be afraid to reject your product idea timely

A business model requires in-depth market and product research that allows you to learn more about your product. You start understanding its infelicities and some market pitfalls. It helps you determine whether your product has a poor market-fit or, on the contrary, prove your concepts and discard all doubts.

If you find out that your product doesn’t bring extra-value to your target audience and isn’t in demand, it’s better to rethink or even give up your product idea at the right moment. It will help you save a lot of precious time spent on communicating with investors that will likely notice the same issues and reject funding your project. Ask yourself as many questions as you can before pitching your product to investors. And be ready to answer them because investors will surely ask them too.

Target the right investor

Not only are they those who choose, but you too. Learn how to target the right investors. Check if they’re relevant to your project. Every investor and funding agency has its peculiarities, and you must be aware of them. For example, some investors don’t fund projects with one-founder teams because they find it unreliable. Pay attention to the project stage, industry, and niche they usually invest in.

What Startups Have More Chances To Get Funded During a Recession

If I were an investor, I would fund startups in the later stages of development. Particularly today, when the global economy is experiencing turbulent times. It seems a more reliable investment since you can estimate the dynamics of the project, how it has been growing over time, what strategies have worked for their target market, and so on. It also allows you to assess the revenue, ROI, and prospect the project’s future with higher accuracy.

However, if to be honest, one of my own projects is at an early stage. Regardless of all biases toward the economic downturn, I don’t find it a reason to stop and not to pitch the product idea to the investor anyway. Actually, it’s my last tip for today: if you have ideas and want to grow your own company, just never give up. Be diligent, patient, and do things as many times as needed to hit success and build a prosperous business.

![How to Pitch a Product Idea to Investors [The Founder’s Tips]](https://fireart.studio/wp-content/uploads/2020/08/photo-1568092461669-88ea238c24eb.jpg)