What’s one little thing that has made our lives easier in recent years? A payment application. Now it only takes a few seconds to send money to your friends and family or to receive a payment. No cash, no annoying checks. However, payment apps are not just helpful in everyday life. They can also be a profitable business idea: the market size of mobile wallet transactions is expected to reach $9,419,619 million by 2025. Want to know how to build a P2P payment app that succeeds? Check our quick guide and learn.

What is a P2P Payment App: The Basics

A peer-to-peer payment app is a kind of e-wallet. This digital platform allows users to transfer money directly from their mobile device or computer to another user’s account. These apps act as intermediaries between the sender and the recipient, processing the transaction and ensuring that the funds are transferred securely.

Unlike traditional payment methods like wire or bank transfers, P2P apps are typically free to use and offer fast, convenient payments that a user can complete with just a few taps on the screen. P2P payment apps are especially popular for common transactions like splitting restaurant bills and transferring money to friends and family members, although they can also be used to pay for goods or services.

The fintech market is competitive, and there are already some nice and popular applications that people love. The most popular payment apps include:

| App name | Number of users, in millions |

| PayPal | 435+ |

| Venmo | 75+ |

| Zelle | 60+ |

| Cash App | 40+ |

| Wise | 16+ |

However, there is always space for another product, providing it can offer unique features and a high level of security, so payment app development is still a great idea.

How Payment Apps Work

Payment apps allow users to link their bank account or debit card to the app and then use it to send and receive money. When a user initiates a transfer, the app securely processes the transaction and sends the funds to the recipient’s app account or, in some cases, directly to their bank account.

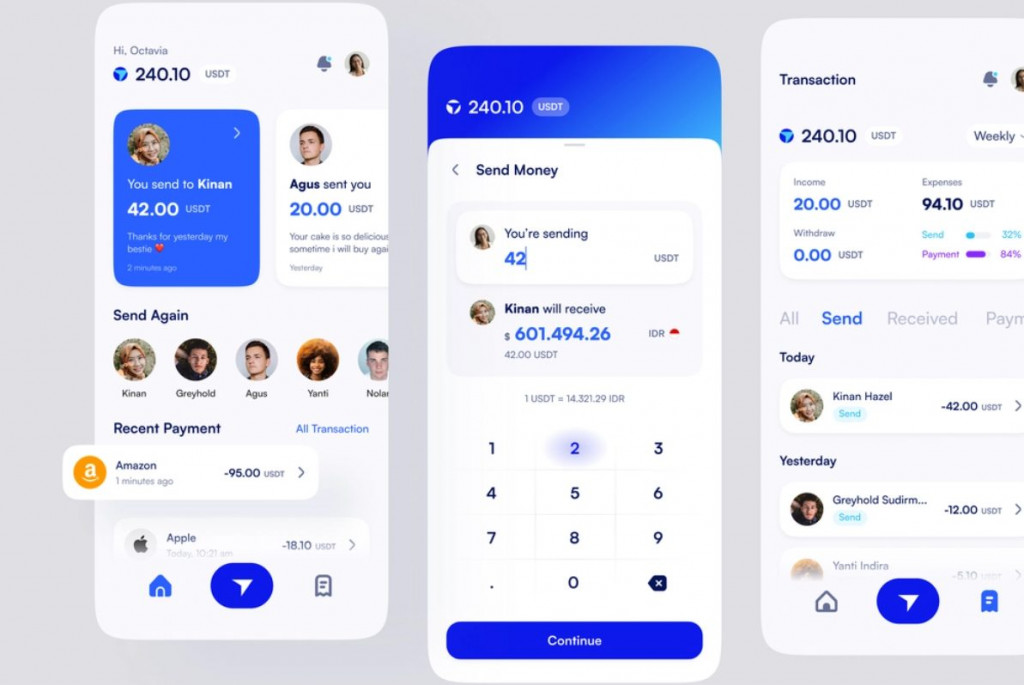

The features vary from one payment app to another (we’ll talk about the must-have ones later), but the typical user journey in a simple P2P mobile payment application looks like this:

- Download the app and sign up. The user downloads the payment app from the app store and creates an account.

- Link a payment method. The user links their bank account or debit card to the app to make payments and receive funds.

- Initiate a payment. The user initiates a payment by entering the recipient’s details, such as their name or phone number and the amount they wish to send.

- Review the payment details. The user reviews the transaction details, including the recipient’s information and the amount being sent, to ensure everything is correct.

- Confirm the payment. The user confirms the payment and may be prompted to enter a password or use biometric authentication, such as a fingerprint or face scan, to verify their identity.

- Send the payment. The user sends the payment, which is then processed by the payment app and transferred to the recipient’s account.

- Receive a payment. If the user receives a payment, they will get a notification when the funds have been transferred to their account. They can then keep the funds in the app or transfer them to their bank account.

Overall, using a payment app is designed to be fast, easy, and secure — that’s what distinguishes it from old-school payment methods.

Why Payment Apps Deserve a Place In a Banking Sector

Payment apps have become an increasingly important tool in the fintech sector. They offer customers a fast and convenient way to transfer money, pay bills, and manage their finances, while giving companies and investors a chance to gain significant profits. The apps have revolutionized the way people think about banking — now, the transactions happen on the tips of your fingers, not somewhere in a bank office.

In 2019, 29% of the US population preferred to pay with a mobile app. This number will only rise, exceeding 5 million users by 2026. So what makes mobile payment app development a profitable idea now in 2023? Why do people love these apps so much?

One of the key benefits of payment apps is that they simplify the payment process — it is exactly why people choose Venmo instead of writing a check or visiting a bank branch. Now, people can easily pay their bills on time, manage their budgets, and stay on top of their finances, all with just one app.

Another important advantage of payment apps is their enhanced security. Payment apps typically use advanced encryption and multi-factor authentication to protect user’s sensitive information and prevent fraud. It has made it safer for customers to conduct transactions online and reduced the risk of identity theft or other financial crimes.

And finally, payment apps have allowed fintech startups to expand their reach and attract new customers. With payment apps, companies can compete with traditional banks and provide customers with a wider range of services.

Overall, payment apps have become an essential tool in the financial technology sector, offering customers a fast, convenient, and secure way to manage their finances. As technology advances, we can expect payment apps to become even more integral to our daily lives and how we conduct financial transactions.

Typical Features of a P2P Payment App

When we’re talking about how to create a payment app, we’re first of all talking about its functionality, the features it must include to be competitive. The basic “send money-get money” app might not fly anymore, so here are the features to think of before you kick off the P2P payment app development process.

Sign-up/Sign-in

This is where you shouldn’t make your users google “how do you set up a p2p payment account”. The sign-up process should be simple and straightforward. Users should be able to quickly and easily create a new account or log in to the existing one, preferably with the option to save their credentials for future use.

Two-factor authentication

Data security issues can make users anxious or turn them to the competitor’s app. Two-factor authentication adds an extra layer of security to the login process, requiring users to provide a second form of identification, such as a code sent to their mobile device or biometric data (FaceID or TouchID).

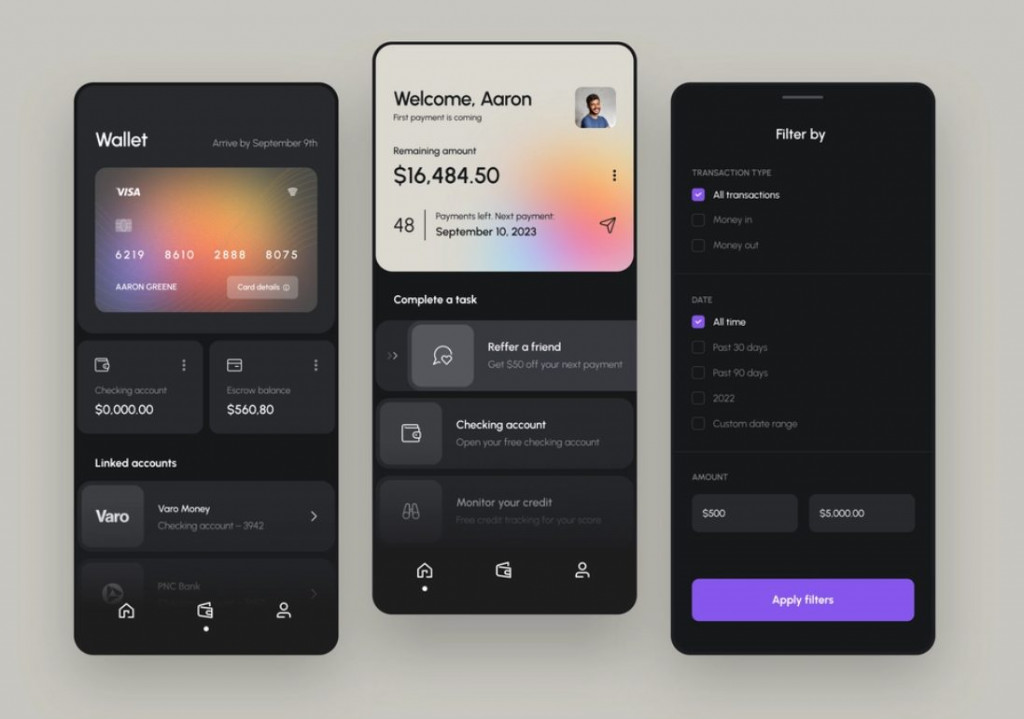

User profile/digital wallet

In their profile, users can store and edit personal information, track the amount of money they currently have in their account, and change their banking details. It allows for easy and quick transactions, with no need to enter your personal info each time you want to send money to someone.

Easy money transfer

Money transfer is the main feature of any payment app, and it needs to be reliable, secure, and user-friendly. Your users should be able to initiate a transfer with just a few taps on their smartphone and send the money from their e-wallet or a linked bank card. The app should also let users receive money from other users, either through unique credentials, a payment link, or a QR code. The transaction process should be fast, easy, and secure, with multiple layers of security to protect users’ financial data. Overall, the goal is to provide a seamless and hassle-free user experience that makes it easy for users to send and receive money anytime, anywhere.

Invoicing/payment request

Invoicing and payment requests are essential for those who need to send payments or invoices regularly. The app should allow users to create customized invoices, including the amount due, the due date, and a description of the services provided. Users should be able to send invoices directly to their clients through the app, track payment status, and send payment reminders.

Automatic currency exchange

Currency exchange is a useful feature for those who need to send or receive payments in different currencies. The app should automatically convert the amount to the appropriate currency using up-to-date exchange rates. Make sure the app allows users to review and confirm the exchange rate before completing the transaction, so there is complete transparency and no surprises in the final amount.

Messaging

Users probably don’t need a full-scale chat feature inside their payment app, but they’ll appreciate it if they can write comments on their transactions and maybe even reply to those comments. Imagine: they send their share of the bill to a friend with a “thanks for a great time!” comment, get their “love you!” reply, and all of it thanks to a simple payment application that you created.

Transaction history

Access to a transaction history feature can be incredibly helpful for users who want to keep track of their spending and payments. With a detailed record of transactions, users can easily see who they have paid, how much they paid, and when the payment was made. Additionally, the transaction history feature can help users feel more secure using the payment app, as they have a clear record of all their financial activity.

Notifications

Make sure your users can easily set up notifications and get alarmed about new transactions, payment reminders, account activity, and app news — but only if they want to. This feature can help improve engagement and keep your users informed, ultimately leading to a better user experience and increased customer satisfaction.

Customer support

When it comes to money, people often have questions, issues, and fears, and your task as an app owner is to help them. Well, not personally, but a friendly and responsive customer support team will do the trick. Alternatively, you can delegate the job to a chatbot if human or financial resources are limited or just as a transition stage between a user and a customer support operator.

Challenges in Developing a Mobile Payment App: What to Expect

Development of payment apps can be an interesting journey with a profit in the end. Still, just like anything else in the financial vertical, it involves a number of challenges and pitfalls that you’ll need to overcome. Here are some of the things to think of before you start developing a P2P payment app:

Regulatory Compliance

Legal compliance is important in any app development, but it gets crucial in fintech. Payment apps must comply with a wide range of legal regulations, including consumer protection, data protection, and anti-money laundering laws — all varying depending on your market. Besides, payment apps must also comply with GDPR, a set of regulations designed to protect user privacy and data. Compliance with all these regulations can be tricky, and failure to comply can result in hefty fines or legal action.

Security Standards

Payment apps hold sensitive financial information, and security is a top concern for both developers and users. Developers should take robust security measures to protect user data, including two-factor authentication, encryption, and real-time transaction monitoring. Additionally, payment apps must be designed to prevent phishing, hacking, and malware attacks.

Payment Gateway Integration

Payment gateway integration is often a critical challenge in payment app development, as there are lots of options to choose from, and the process must be seamless and error-free. Payment gateways must be compatible with the app’s technology and be secure, reliable, and fast. Developers must also ensure that a chosen payment gateway supports multiple currencies and payment methods, as users expect to use the ones they prefer.

Cross-Platform Compatibility

You need to make sure that the team working on your app is experienced in cross-platform development, as payment apps must work seamlessly across multiple platforms and devices. To keep its place in the competitive market, the app should be compatible with various operating systems, screen sizes, and resolutions. It’s important that the users have a consistent experience regardless of where they open your app.

Scaling and Performance

P2P payment apps must be designed to handle a large number of users and transactions without sacrificing performance. As the user base grows, you should be able to scale the app, so it can handle increased traffic and transaction volumes with no downtime or performance issues. It often becomes a critical challenge for app developers and is a factor to consider before you start developing the app.

Develop A P2P Payment App Step-by-Step

Now that you are aware of the challenges you can expect along the way and have a basic understanding of the features to include in your app, it’s time to get to the development process. While it might vary from one company to another, the general mobile app development cycle usually looks like this.

Step 1. Assemble the team

First and foremost, you’ll need people who know how to create a mobile payment app and can do it for you. The team size will vary depending on the app’s complexity, urgency, and the resources you have, but the key roles usually include:

- Project Manager — responsible for overseeing the entire development process, ensuring deadlines are met, and the project stays within budget.

- Business Analyst — responsible for market research, identifying user needs, and creating a project roadmap. This role can be overlooked in smaller projects.

- UI/UX Designer — responsible for creating a visually appealing and user-friendly app interface.

- Developers — responsible for writing the code that powers the app, including front-end and back-end development.

- QA Engineers — responsible for testing the app to ensure it functions as intended and meets user requirements.

Step 2. Create the app concept and research the market

The discovery phase is vital for the app’s future success. At this point, you’ll need to research the market to ensure that your app has a unique selling point to make it stand out among the competitors. Then, you should create the app concept with the requirements your team will be implementing at the next stages of the development process.

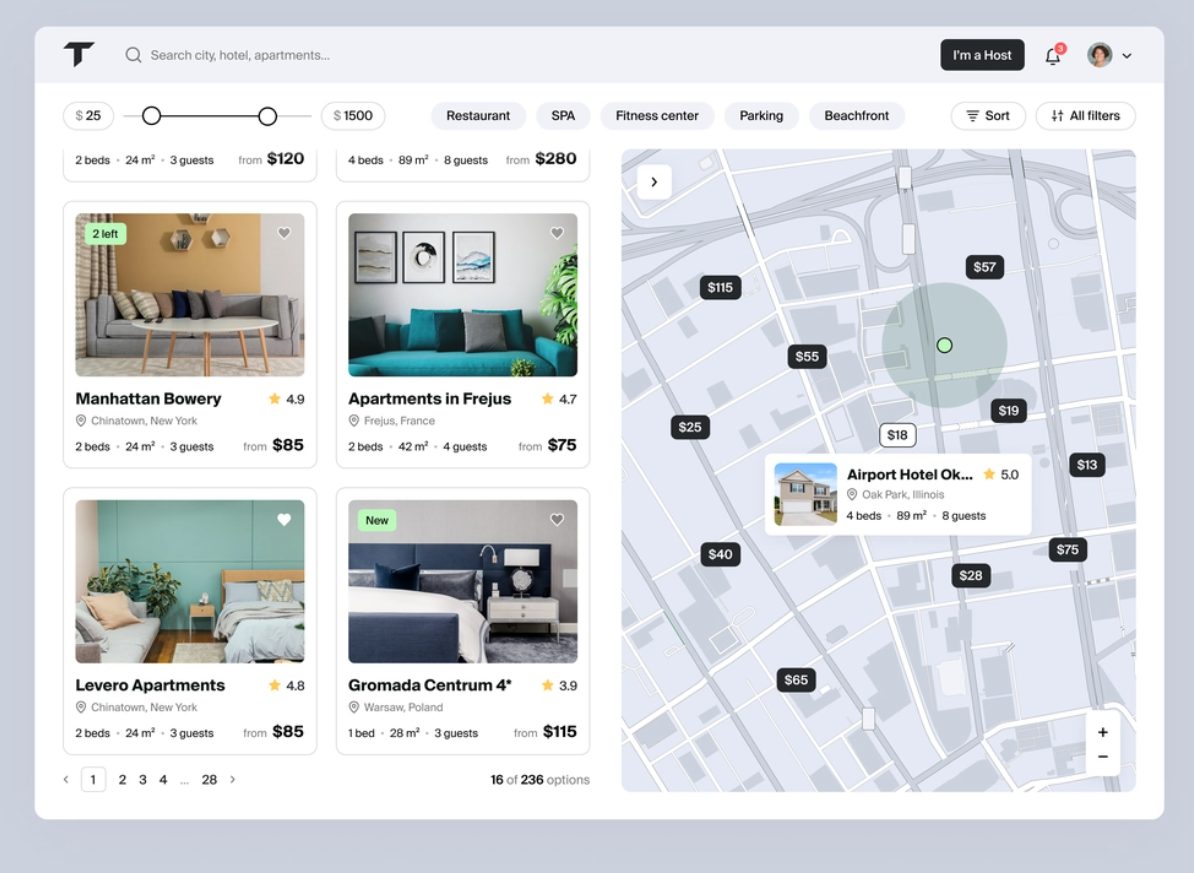

Step 3. Create UI and UX design

Once you have a clear concept and an understanding of what users expect, the next step is to design the UI and UX of your app. This step involves creating, first of all, wireframes and mockups to understand your app’s layout, navigation, and interactions, and then the final versions of the app design. The UI should be intuitive, user-friendly, and visually appealing, while the UX should ensure the app is easy to use and provides a seamless experience for users.

Step 4. Develop the app

This step is where the actual app development takes place. The team of developers will build the app architecture, write the code, design the database, and integrate the necessary features and functions into the app according to the requirements outlined in the earlier stages. The development process will require constant communication and collaboration between the team members and the client to ensure the app is built according to the design and functionality requirements.

Step 5. Perform thorough testing

After the development stage, the app needs to be thoroughly tested to ensure that it functions properly and is free of bugs and errors. The QA team will use a range of methods, including functional, usability, and security testing, to identify any issues or problems with the app. They will also simulate user behavior to be 100% sure the app works as expected under different scenarios.

Step 6. Deploy and launch the app

Once the testing phase is completed and any bugs or issues have been resolved, the app is ready for deployment. This process involves preparing the app for release, configuring servers and databases, and creating the necessary infrastructure to host and support the app. Once the app is deployed, it is ready for launch, and users can finally download and use it.

Step 7. Promote the app

Once the app is launched, you need to let the world know it exists and it’s awesome. You can opt for social media marketing, influencer marketing, search engine optimization, paid advertising, and whatever else you can think of. The marketing team will highlight the app’s unique selling points and make sure it reaches the target audience you defined at the first stage of the development process.

Step 8. Maintain and update the app

The work never stops at the launch. You’ll need to constantly maintain and update it to ensure its success and longevity. It includes bug fixing, implementing new features, and ensuring the app runs smoothly. One of the vital things at this point is to listen to user feedback and address any issues promptly — no one knows what’s great about your app and what needs to be improved better than the users.

Technology Stack for Payment App Development

When it comes to developing a P2P payment app, choosing the right technology stack is crucial for ensuring the app’s reliability, security, and performance. It will be determined by the fintech app developers from your team according to the app’s specifications and will most likely include some of the following popular technologies for payment app development.

| Technology Category | Popular Technologies |

| Programming Languages | JS, Python, Swift |

| Databases | MySQL, MongoDB |

| Frameworks | React Native, Flutter, .NET |

| Payment Gateway Integration | Stripe, PayPal, Braintree |

| APIs | Twilio, Firebase, Google Maps API |

How Much Does it Cost to Create a Payment app?

The next reasonable question after the “How to make a p2p payment app?” is always “How much will it cost me?”. However, the final price will vary depending on a number of factors, including the app’s complexity, features, and the development team’s hourly rate, which in its turn, greatly depends on the location. In general, developing a P2P payment app with basic features can cost around $50,000 to $100,000. For more complex apps with advanced features like in-app messaging, analytics, and multiple payment gateway integrations, the cost can range from $150,000 to $300,000 or more. Additionally, ongoing maintenance, updates, and customer support will also contribute to the overall cost of the app.

The easiest way to define the approximate budget you’ll need to create the app is to directly contact a mobile app development company, share your ideas, and get the offer.

Fireart Studio Can Build A Payment Application For You

Speaking about fintech app development, it’s an area in which Fireart has extensive experience. Whether you need a P2P payment app or mobile banking application development, Fireart experts can bring your ideas to life at a competitive price and within reasonable time frames.

Our team of experienced developers, designers, and project managers will work with you closely to understand your unique requirements and deliver a high-quality product that meets your business needs and exceeds your expectations. We offer transparent pricing and flexible hiring models so that you can choose the option that works best for your project.

If you’re looking for a professional team to build your application — contact us today and learn more about our payment app development services and how we can help you bring your vision to life.