If you had to leave only one app on your smartphone, the chances are high that it would be your bank’s app. The benefits of mobile banking are countless, and more and more customers understand it every day. According to the statistics, 217 million people will be using digital banking by 2025, and it’s in the US only. So what is a good mobile banking app, and which features should it have? Let’s find out.

Basic Features of A Mobile Banking App

Imagine you decide to develop a digital banking app with a mvp development company and need to define which features you need for your MVP. If you ask your potential customers: “What banking features are important for you?” most people will name the basic banking operations and details that are not so difficult to implement. Here are six basic features that are must-haves for any mobile banking application.

Easy Account Statements

The most common reason for a mobile banking app use is to get a simple account statement: more than 90% of all users use their digital banking to check how much money they have left. So this is a must-have for any app. And it’s not just about the amount. With this feature, users can view their transaction history and track their expenses in real time. Even better if the users can download their statements in various formats, such as PDF or CSV, to share them with their accountant or financial advisor if needed.

Inter-Account Transfer

A lot of users have several accounts within one bank: checking, savings, credit, etc. With an inter-account transfer feature, users can easily transfer their funds between different accounts and pay off their credit card bills. It’s hard to imagine that some time ago, you would need to go to the physical branch and fill out a slip just to transfer several hundred dollars from one of your accounts to another.

It’s a simple feature, but it still needs to be well-implemented. Users should be able to choose the source and destination accounts, enter the transfer amount and confirm the transaction. The app should also display a clear transfer confirmation, including the amount transferred and the transaction date and time.

Person-To-Person Transfer

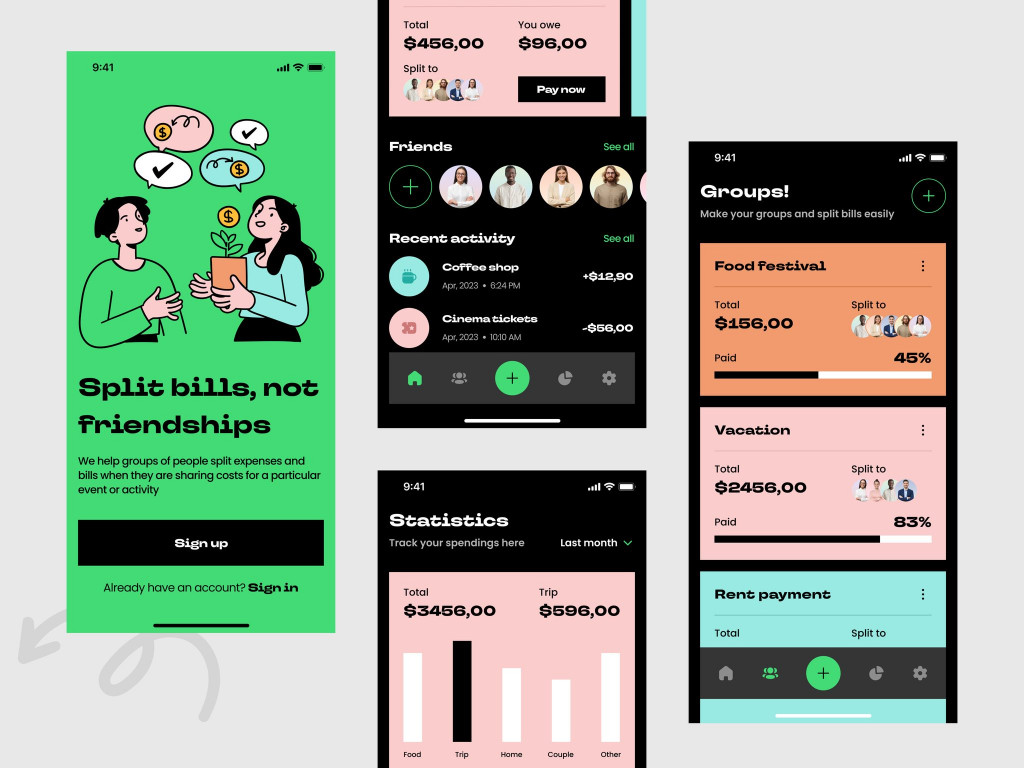

Another feature that completely transformed our relationships with banks is P2P transfers. With this feature, users can send money to friends, family, or anyone with a bank account. Some applications also allow users to request money from others, making it a great option for splitting bills. You won’t write a check to a friend who just paid for your coffee, will you? P2P payments are a must-have for any digital banking app, and the better this feature works and the more money transfer options it offers, the more customers will be using the app.

Online Bill Payments

Users need mobile apps to make their lives easier. So adding the feature that will allow them to pay all the bills swiftly — and to remember about those bills — is a great idea. Users should be able to schedule payments, view their payment history, and get reminded about upcoming bills to avoid late fees. Some apps also allow setting up automatic payments for recurring bills, such as rent or utilities, and some let a user split bills between several family members, for instance, but we’ll talk about this feature in the next part.

ATM Locator

It sounds like a minor detail, but it’s actually a very convenient feature that is often overlooked in digital banking apps. Yeah, we can use a card or even a smartphone to pay for almost anything, but there are still situations when you need cash. And these situations usually happen when you’re not ready and have a $1 bill in your back pocket. With an ATM locator integrated into a banking app, users can search for ATMs by location or bank and see which ATMs are fee-free. Just a small aspect on the one hand, and a competitive advantage on the other hand.

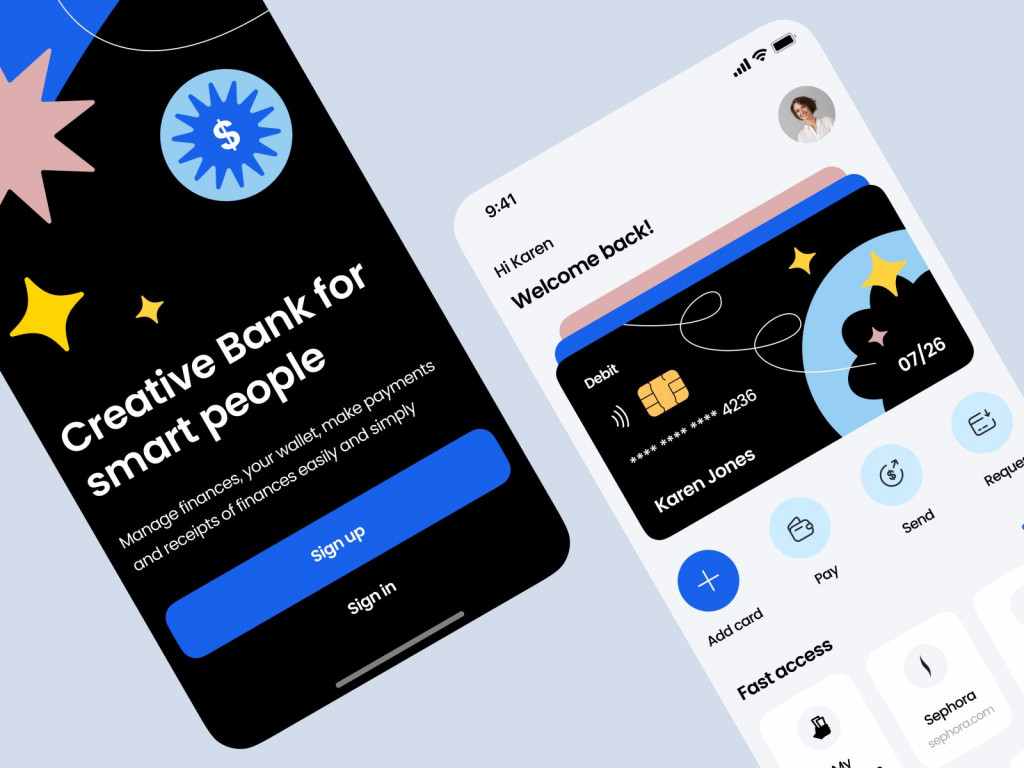

Adaptable User Interface

It’s not just about the app’s features and functionalities but also about how it delivers them. A well-designed user interface can make or break a user’s experience with the app, and it can be the deciding factor for many people when it comes to choosing which app to use. The fintech market is quickly developing, and the level of competition is high, so an old-school app with a complicated and buggy interface just won’t fly.

An intuitive layout, easy-to-use navigation, and quick access to the most frequently used features are some of the key components of a good user interface. It should also be designed to provide a seamless user experience on different devices, whether a smartphone, a tablet, or a laptop.

In addition, an adaptable user interface also means being able to cater to the diverse needs and preferences of different user groups. For example, customizable themes, font sizes, and colors can greatly enhance the user experience and make the app more accessible to a wider audience.

Security Mobile Banking App Features

If you ask people who don’t have a banking application why they miss such an opportunity to save time and effort, they’ll most likely tell you that it’s for security reasons. Security is a number 1 priority for many users, especially when it comes to money. There are many fears and anxieties. What if someone gets unauthorized access to my money? What if there is fraud? As an app owner or developer, you have to understand those fears and do your best to provide top-notch security and protect users’ money as heavily as you can. With the help of the following security features, for instance.

Two-Factor Authentication

Two-factor authentication (2FA) is a security feature that provides an extra layer of protection by asking app users to provide another form of identification aside from their login and password before they can access their accounts. 2FA makes it much more difficult for unauthorized parties to gain access to user accounts, even if they somehow got the user’s login credentials. This “another form of identification” is usually a unique code sent via SMS or generated by an authenticator app.

Implementing two-factor authentication requires a robust system that can generate and manage unique authentication codes, but this is an investment that you can hardly avoid — users might still pick your app if it doesn’t have an ATM map, but they will 100% skip it if the app is not secure.

Biometric Authentication

Biometric authentication is another way to add a layer of security to your digital banking app. It uses unique physical characteristics, such as fingerprints, facial recognition, or (in very rare cases) iris scans to verify the user’s identity, once again making it impossible to login into the account if you’re not the user’s identical twin.

The process of biometric authentication involves capturing the user’s unique physical characteristics with a device’s built-in sensors, such as the camera or fingerprint scanner.

Once captured, the app compares the data against a previously stored record to determine if it matches. If it does, the user is granted access to their account. If it doesn’t or there is no record, the user will be required to provide an additional form of identification.

Suppose you decide to incorporate biometric authentication into the app. In this case, you’ll need to make sure it’s designed to store and protect biometric data securely, so think of using encryption and hashing techniques to prevent unauthorized access.

Users should also have the option to enable or disable biometric authentication in the app and set up additional authentication methods in case biometric data is not recognized or not available. Because, well, sometimes, you just don’t look like yourself.

Account Use Warnings

This feature might sometimes annoy users, but it’s another way to make them feel more protected. The warnings help protect the user’s account from unauthorized access or fraudulent activities by sending real-time alerts whenever the account is accessed or used in certain ways, whether a login from a new device or location, a large transaction is initiated, or any other suspicious activity is detected.

Account use warnings can also be customized based on the user’s preferences and set up to only notify the user of certain activities that they deem important or suspicious. For example, the user may want to receive a notification only when a transaction exceeds a certain amount or when a specific vendor is used.

To implement account use warnings in a mobile banking app, you need to ensure that the app is designed to detect and analyze account activity accurately and quickly. It should also be equipped with a notification system that can send alerts or notifications to users in real time and provide relevant details about the activity — but it would be helpful for many other things as well.

Innovative Features of Mobile Banking App

Now that you know how to create a secure but quite basic app, it’s time to think about how you can enter the world of innovative online banking and succeed. As the competition is intense, you’ll need to add some innovative features to your app to stand out and win the users’ hearts. Here are some of the ideas you might use for inspiration:

Crypto-Assets Integrations

It’s quite a rare feature, but it’s also the one many users dream about. With such a feature, users will be able to manage their cryptocurrency investments and holdings directly within their mobile banking app, eliminating the need to download 5 more apps to deal with all their crypto.

The crypto-assets integration typically includes the ability to view and track the user’s cryptocurrency portfolio, buy and sell cryptocurrencies, and transfer cryptocurrencies between accounts. The feature may also include access to real-time market data, price charts, and news feeds related to cryptocurrencies.

To enable crypto-assets integration in a mobile banking app, you’ll need to have a reliable and secure platform for buying, selling, and storing cryptocurrencies and integrate it with the app’s existing banking infrastructure, allowing users to transfer funds between their fiat and cryptocurrency accounts seamlessly.

Other critical aspects here are security and legal compliance. You’ll need to implement robust security measures and ensure compliance with local regulations and laws, as cryptocurrencies are subject to various regulatory requirements that significantly vary depending on the location.

QR Code Payments

With QR payments integrated into the mobile app, users will have a convenient and secure way to make transactions when they don’t have a physical card with them. In a mobile banking app, QR code payments typically involve the following steps:

- First, the user scans the QR code presented by the merchant or recipient;

- Then, the app verifies the payment amount and asks the user to confirm the transaction;

- Finally, the payment is processed, and the user receives a receipt or confirmation of the transaction.

For the feature to be implemented, the app must usually be integrated with a payment gateway that supports QR code payments. It will act as an intermediary between the user and the merchant or recipient, facilitating the transaction and processing the payment.

A thing to note: there are various QR code standards, and the app must be able to recognize and process QR codes from different sources, so it’s compatible with a wide range of merchants and recipients.

AI-Powered Chatbots

With an AI-powered chatbot, you can save money on a customer support team and help users get answers to the most popular questions at the same time. With AI and machine learning technologies, the chatbot can understand natural language and respond to user inquiries, provide customer service, and assist with various banking transactions.

In digital banking apps, the feature typically appears as a chat window or icon. The chatbot can answer common user questions and provide guidance on banking products and services, such as loans, credit cards, and investments.

Chatbots can provide a significant advantage to mobile banking apps as they increase customer engagement, reduce wait times for customer service, and improve the overall user experience. By using machine learning algorithms, the chatbot can become more intelligent over time, learning from user interactions to provide more personalized and accurate responses.

ATM Withdrawal Without a Card

If you ever realized you forgot your card while standing in front of the ATM with a long line behind you, you understand that this feature can be really helpful.

It usually works like this: the user initiates a withdrawal from within the app, which generates a unique code valid for a short period of time. The user then inputs the code into the ATM along with other authentication information, such as a PIN, to complete the transaction. In other cases, the transaction can also be initiated and confirmed by scanning a QR code on the ATM.

This feature provides several benefits for users. Firstly, it eliminates the need to carry a physical card, which can be lost, stolen, or damaged. Secondly, it can make ATM transactions faster and more convenient, as users don’t have to insert a card and wait for a card reader. Finally, it can enhance security by reducing the risk of card skimming and other forms of fraud.

Gamification

Let’s be honest, a banking app doesn’t sound like something that can be fun. But you can actually make it less boring by introducing gamification mechanics — the thing that increases user engagement (and screen time) like nothing else.

Gamification can take many forms, but some common examples include challenges, rewards, and badges for users who achieve certain milestones or complete specific actions. For example, a user might earn points for making a deposit or a certain number of transactions. The points can then be used to redeem rewards, or they can just be there, it was fun to get them already.

Another example of gamification in mobile banking is financial literacy games and quizzes. They can teach users about complex financial concepts in a fun and interactive way, help them improve their financial literacy, and develop better money management skills.

Shared Finances

This feature is particularly useful for families or roommates who share expenses and want to track their spending and savings collectively. It allows users to invite other members to join the shared account and assign specific permissions to each member. For example, the primary account holder may have full access and control over the account, while the secondary users may only have the ability to view account information and make transactions up to a certain amount. Users can also set spending limits and receive notifications when a transaction is made or when the account balance falls below a certain threshold.

FireArt Expertise in Innovative Mobile Banking App Development

When we’re talking about banking app development, it’s not just a theory, it’s practice and real-life experience. At FireArt, we understand how important it is to stay ahead of the curve in the ever-evolving digital banking world, and we know how to provide a full range of design and mobile banking app development services, from the first idea to the very moment of launch — and even after the launch.

We know everything about the latest technologies and trends in mobile banking app development. Whether it’s biometric authentication, AI-powered chatbots, or gamification mechanics, we’re equipped with the knowledge and expertise to incorporate these cutting-edge features into our products.

Conclusion

Mobile banking has become an essential aspect of financial services, and it’s not going away anytime soon. With the growth of digitalization, customers demand user-friendly and secure mobile banking apps that provide convenient and innovative features, from the basic ones to state-of-the-art features.

And while physical bank offices still exist and push our buttons, they might give place to mobile banking apps anytime soon, considering how quickly the industry grows and evolves. New apps appear every month, some of them manage to stay, and some are swept away by competition. If you are considering joining the fun and developing a mobile banking app, we invite you to partner with us at Fireart Studio. We know how to do it, we’ve done it before, and we can do it once again — this time for you.