Loans are not a new concept in the financial sector, but due to the increasing impact of digitalization, cash lending has become easier. The digital lending platform market size was valued globally at $7.04 billion in 2022 and is growing rapidly.

Besides driving market growth of fintech, loan apps offer such benefits as an enhanced optimized loan process, quicker decision-making, compliance with regulations and rules, and improved business efficiency. You don’t need to visit banks and go through complex procedures, just grab your phone and make a few taps.

But what does it take to hire android app development company and build a peer-to-peer lending money app? In this article, we will share our knowledge and provide insights on how to build one of the best money-lending apps.

What Is a Lending App?

Lending applications are apps developed to help people get loans instantly. The sign-up process usually consists of a few simple steps — you register, verify your personal information and fill out your profile. To get a loan, users just need to select the sum they need, choose the interest rate, and connect their bank accounts to their lending app accounts.

How Does P2P Lending Work?

Peer-to-peer money lending does not involve any intermediaries like loan brokers and banks. There are only two equal parties — the lender and the borrower, who negotiate the deal details between each other, such as loan rates and repayment conditions.

Let’s see how a P2P lending app works. A borrower issues a loan application which is approved by the platform after a security check. A lender looks through the list of loan applications and decides which one is the most suitable for them. The profit comes from a percentage of every loan or subscription fee. This way, interest rates, and terms are beneficial to all parties involved as there are no intermediaries.

Types of Lending Apps

There are several types of loans depending on the borrower and the lender. Therefore, lending apps also come in different shapes and sizes. Let’s start with the borrower-centric classification.

Student loan apps

Money-lending apps are created to facilitate education and help students with financial matters. LendKey is one of the loan apps for students. It offers flexible repayment options and competitive interest rates. They can help you cover the cost of your tuition and other expenses associated with college.

Personal loan apps

Such loans are used for personal purposes to cover unexpected or extra expenses. For example, Dave is one of the apps that provide such types of loans. It offers up to $500 in cash advances in case you need money to avoid overdraft fees or to cover a minor expense. In addition, the app doesn’t charge interest. Instead, you have to pay a $1 membership fee.

Startup or small business loan apps

For small businesses and startup owners, using lending apps is an alternative to visiting local banks. Kabbage is a loan app that can offer small business owners a credit of $2,000 to $250,000.

Money-lending apps can also be categorized according to the lenders they accommodate. Here are the most common types.

P2P lending applications

The peer-to-peer lending apps allow you to present your loan requests to many different investors at once, increasing the chances of getting a loan. For example, Upstart is a peer-to-peer lending app that was launched in 2012. Instead of evaluating only a credit score, they also take into account the borrower’s academic performance, work history, and even potential earnings — all that information is displayed to potential investors.

Apps of banks and other financial institutions

Lending is usually one of the features of a comprehensive banking app. For example, Bunq offers easy mortgages. Instead of waiting several weeks to get your mortgage proposal approved, the user can get a mortgage proposal within just 24 hours.

Credit union apps

It is usually easier to obtain a loan from a credit union than from a large bank. For example, Brigit is a financial health app that connects to your account and runs in the background to help you budget better and get up to $250 when you qualify for instant cash. You get the money instantly and can repay it whenever you need it.

While these are the main categories of money-lending apps, there are also must-have features that these apps all have in common and should be taken into account in the development process.

Money-lending application’s Core Features

A sleek interface is what makes a lending application easy to use and competitive on the market full of same-purpose apps. Thus, it’s essential to choose a set of features carefully, so you can win over your users.

Basic features

These features are implemented at an early stage when you are only testing the market and wish to understand your customers better.

Registration: It’s an essential part of any app. Users should be able to quickly register using their email or phone number. The simpler this step is, the higher user adoption will be. You also don’t have to ask for all the user data at this stage, just do it later when they start asking for a loan.

Loan application form: The core of any money-lending application. Such a form works better for customers if it’s broken into several steps on different pages. If a user stops midway, the data should be saved so that they would be able to continue where they left off.

User profile: That’s a space for your users to fill in their personal information and edit details. To make this process more intuitive, consider adding some examples to the fields.

Notifications: Push notifications are an essential part of any app. In the case of a money-borrowing app, they are crucial to update users on the next payments, the due dates, or missed payments.

Payments log: Users should see pending and completed payments, so they can instantly check the amount of remaining debt.

Advanced features

Once you’ve built the basic features, you can move on to reviewing some additional options and developing more advanced ones. The following features are essential for creating one of the best money-lending apps:

Payment options: Nowadays, there are many payment options available, and your user should be able to choose the one they like. Allowing users to add and edit their banking information is essential. They will be able to start loan repayment right from the app.

Credit score: Integrating a credit score service into your application will help your users to make better loan decisions, as well as understand their loan eligibility.

Loan calculator: Instead of having to use a separate calculator, users would prefer an all-in-one app. Thus, they will instantly estimate the monthly payments, down payment, interest rate, amount of interest, and loan fees.

Live chat support: A good lending money app should be intuitive so users require no help. Many companies rely only on chatbots to answer typical questions. However, the need to consult a human expert may still arise. Providing such an option will help you win over your competitors.

Things To Consider Before Starting Lending App Development

There are foundational steps to take before diving into the intricacies of creating your lending app. Here are the things to consider before you start.

Discovery & Research

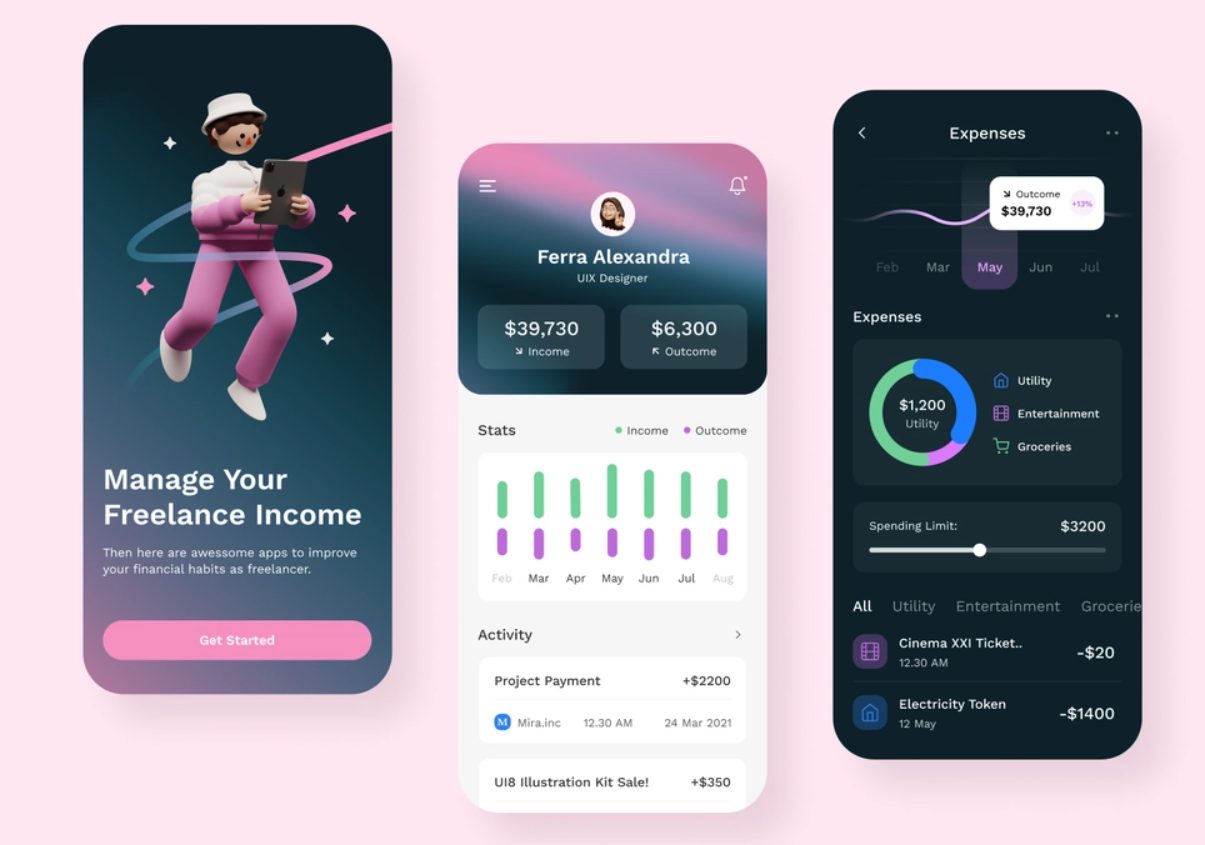

Created by Fireart Studio

Before building an actual app, you should consider the scope of your app and the key idea behind it. This is where the successful foundation of lending app development lies. As part of the idea definition, you should consider what type of problem this app will resolve, its functionality, and its target audience.

In addition, market research is what will help you assess the state of the market, learn more about your competitors, and analyze their successes and failures. Afterward, you will be able to outline the scope of the project, define the budget, and set priorities and deadlines.

Legal peculiarities

Regulations may vary from country to country as well as within a country. Legal experts are required to handle this side of the project. You need them to help you monitor all the policies and procedures, as well as ensure they are up-to-date and meet the regulations. This way, you decrease the risks regarding the lending process.

Security

An essential part of any fintech development is security. People are always careful when it comes to money. It’s one of the key factors that make customers decide where to borrow. Therefore, your money-lending app should convey a sense of safety to your users. This can be achieved in different ways, such as:

- Authentication: A lending app needs a way to authenticate users. This can be with the help of biometric security provided on the smartphone, for example, fingerprint scanning or face recognition. This way, you help users protect their personal data. To take a step further, you can implement two-factor authentication. For this, there are also services like Twilio and Duo.

- Encryption: Money lending involves the exchange of sensitive information through the app, therefore, encryption of all data is a must. In addition, encryption has been on the consumer apps market for a while, so it’s easier than ever to implement it.

Promotion & Marketing

As with any SaaS company, your businesses will need proper promotion and marketing to let people know about your app. You can start growing your in-house team, but hiring an outsourcing company is also an option. Public relations and marketing companies will help you promote your app and earn the recognition of your target users.

How to Create a money-lending app: 6 Key Steps

Created by Fireart Studio

After you have studied the market and considered the financial and legal aspects, it’s time to focus on the development. These are its six key stages.

1. Select the technology stack

To build a money-lending app, you have to decide which platforms it will support. Is it only going to be available on the web, or are you planning to make dedicated mobile apps for all parties?

You must carefully choose the most appropriate tech stack. A technology stack is the combination of technologies you need to build your app. To select the best tech stack, you should consider such aspects as data security, performance, future scalability, integration possibilities, and ease of adding new features.

There are many possible technologies you can use you start loan lending app development. The list may include JavaScript, React, Angular.js, Vue.js, Node.js, React Native, Lavarel, HTML/CSS, and more.

2. Gather a team

The success of any project is always the sum of the development team’s efforts. As an app owner, it’s your responsibility to hire the best team members. Should you build an in-house team, hire a software development agency or stick with freelance developers? The choice depends on how quickly you wish your development to begin, the complexity of the project, and your budget.

For example, Fireart is a design and software development studio. Our Fintech app development team consists of app development and design experts. We have 6+ years of experience in building digital projects from scratch or upgrading existing ones.

3. Focus on UI/UX design

Created by Fireart Studio

The UX and UI are what make your loan app and should be presented at the earliest stage of your development. At this stage, you get the wireframes and test the screen prototypes with customers. You should focus on maximizing the aesthetic appeal of your app while also improving its user engagement rate, responsiveness, and efficiency. A clickable prototype is what will help you to understand user experience better.

4. Development

After successful verification of UX/UI design with some of your future customers, you can now move on to building your money-lending app. It’s good to start with basic features and build MVP (minimum viable product) and test the idea’s feasibility in a chosen target market.

Therefore, you should focus on implementing the basic features we have mentioned before in this step. And once you get a desired customer response, it’s time to start developing the scaled-up loan app with more advanced customer-oriented features.

5. Testing

Before launching the application, it is crucial to check its stability and performance. The developers focus on finding and fixing bugs that may interfere with application functions. The app should be tested from the user’s perspective to see how UX/UI works. This way, you identify issues and prevent them, so users can enjoy the flawless app and convenient design.

6. Maintenance

Technology keeps evolving, new features are added, and new opportunities are presented. They improve user experience and give space to build better applications. Therefore, it’s critical to keep your money-lending app up-to-date. For instance, the new iPhone update provides full support for Dark Mode, so your app is expected to provide such functionality as well.

Money-lending app Development Сost

The cost of building an app varies from $32,000 to more than $60,000, depending on the features and tech stack. For example, iOS apps generally take less development time, therefore, they are cheaper to build and maintain than Android apps. Here is an approximate breakdown of pricing:

| Ready-to-Market Application with Basic Features | Application with Advanced Features | ||

| Discovery, Research and UX/UI Design | Hours | 170 | 320 |

| Cost, $ | $6 000 | $11 500 | |

| App Developemnt | Hours | 460 | 830 |

| Cost, $ | $17 500 | $31 500 | |

| Testing & App Launch | Hours | 310 | 570 |

| Cost, $ | $9 000 | $16 000 | |

| Total | Hours | 940 | 1720 |

| Cost, $ | 32 500 | 59 000 |

The amount you will need majorly depends on the team and their expertise. According to their experience, their hourly rate will vary, as well as the end result and complexity of features.

You can learn more precise pricing by reaching out to our team. The Fireart team can specify the cost of such a project and ensure successful loan lending app development.

Money-lending app Development in Fireart

Created by Fireart Studio

We have answered the question about how to create a loan app. There are a lot of aspects to consider that require experts in finance and law. If you think about building a loan app, you can use this article as a starting point and get answers to all the frequently asked questions.

Fireart Studio is an award-winning UX/UI design and product development agency. So a money-lending app development with the best UX/UI design is what we love and know how to do. When developing an app, we focus on bringing clarity to UI and ensuring awesome UX.

When dealing with a project, we always include a design research phase, creating illustrations, development, and quality assurance. To better understand the users, designers study user personas before starting the product design phase. The Fireart team regularly showcases supreme achievements in product design services, having been dealing with digital product design and development for over a decade.

Contact us and get the work on your money-lending app started!