The scale of investments from IT Services Companies in financial technologies nowadays is immense. And the costs of FinTech are growing annually since technological leadership is becoming the main priority of global companies today. That’s why how to build a FinTech start-up today with is quite a reasonable point.

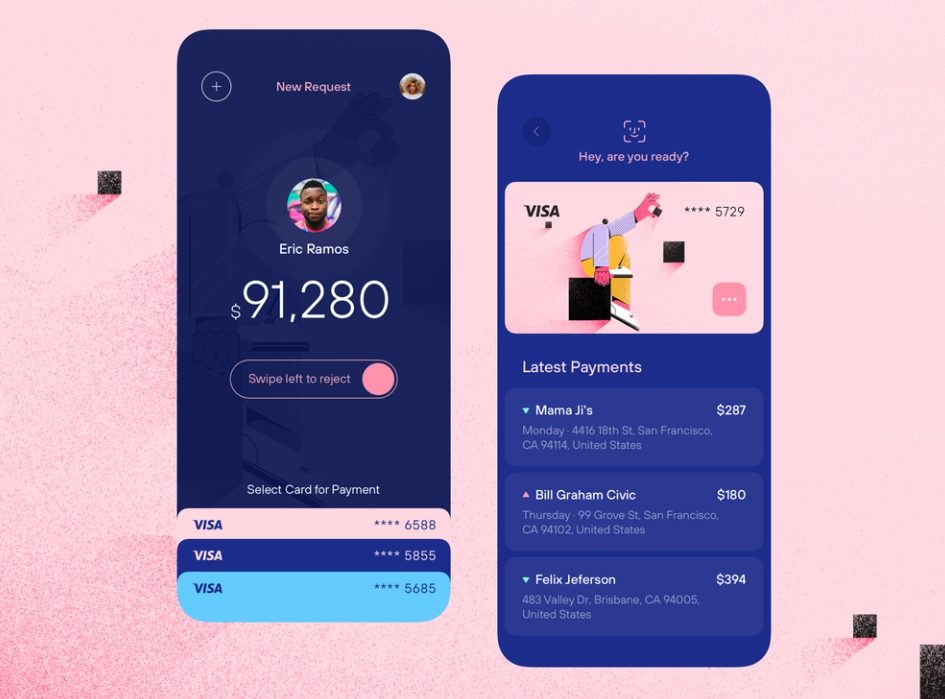

A Wallet Concept

What’s FinTech?

Fintech (financial technology) or fintech app development services provide financial services using digital technologies and b2b marketing saas. These may be big data, artificial intelligence and machine learning, blockchain, cloud technologies, and many others.

Fintech is an industry where companies use new solutions and technologies to compete with traditional financial institutions for customers. Simply put, this software makes relationships with finances more accessible, faster, and reliable.

Top FinTech technology trends

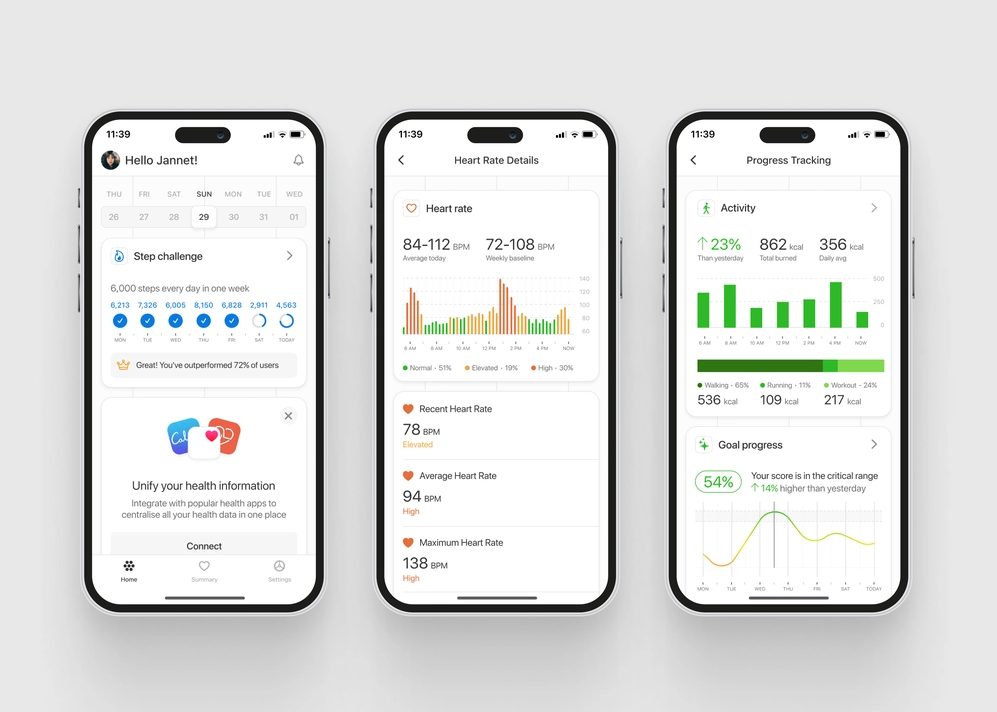

When you are about to decide to create your next finance project, how to build a FinTech app or even establish a FinTech company, or effective website will be the next issue to solve. There are no excellent financial services without an incredible UX website or mobile app, that’s true. You may choose from the top trend technologies for your project.

Big Data

Big Data is a fast-growing large dataset and tools for working with them. Tools are needed to analyze hundreds and thousands of sources in order to collect the most complete information about the client. Structured data is used for statistics, analysis, forecasts, and decision-making.

Blockchain

A blockchain is a database that may contain information about all transactions. The data is stored as a chain of blocks that’s why it’s called a blockchain. Each may contain a certain number of transactions. At the same time, the technology is confidential, as it allows you to store data in encrypted form. Blockchain is widely used in the field of cryptocurrency app development to ensure their turnover.

AI

Artificial intelligence (AI) and machine learning are a trend. AI is a system or machine that can mimic human behavior to perform certain tasks. IT is also able to study human behavior and gradually learn using the information received and so much more. Highly technological apps are using AI for top-notch data processing and self-learning.

RegTech

Regulatory Technology (RegTech) is an innovative FinTech technology trend that enables companies to expand and adjust to the weight of regulatory reporting expansion. RegTech is a fast-developing technology that allows for tracking the legality and correctness of actions automatically. Regtech’s tasks include customer identification, data processing and protection, financial risk analysis, and dispute resolution. This will help you comply with legal regulations and avoid problems while being a smart and secure technology.

Suptech

Alongside RegTech, Suptech is another technology to apply. It’s a short form of the so-called Supervisory technology. SupTech refers to the technology that supports FinTech supervisors. The Bank for International Settlements (BIS) defined it as ‘the use of innovative technology by supervisory agencies to support supervision.’

IoT

The Internet of things (IoT) is a wast network of objects of the real and virtual world connected to the Internet and capable of exchanging data. It may significantly improve many areas of our lives and help us create a more convenient, smarter, and safer world, including finances.

How to build a FinTech app

World statistics: in about 96% of cases, there is always one FinTech application installed on the surveyed people’s smartphones.

Thus, the FinTech industry offers a variety of development directions from which you can choose to develop your project. Artificial intelligence, machine learning, RegTech or the internet of things are just some of the most advanced technologies used to solve various problems in the FinTech industry.

Choose a developer

Choosing a worthy development company is an important decision. The project’s success depends on it. When defying the exact cost and development time, it is better to first form detailed terms for reference and provide them to the developer.

Create a technical task

As part of the technical task for the project, it is possible to estimate the hours required for all stages of work, and calculate the total cost. The whole process usually looks like this:

- Task development.

- Agreement of conditions.

- Development.

- Internal testing.

- Delivery of the product.

It is reasonable that the drafting of the terms or references is indicated as the very first. If you do not have a technical task or have difficulties with its creation, then we provide development services for A to Z. Provide your brief to a digital product agency and start working.

Skyrocket your project

Fireart specialists are able to develop applications that can withstand any load that meets security and encryption standards. Your customers will be able to use your FinTech application safely. They will show loyalty to your brand without even looking at competitors’ directions when they like what you do.

Compliance with all the deadlines is equally important because the project usually consists of several stages. Therefore, entrust it to a professional development team that will promptly create any quality FinTech product.

How much does it cost to build a FinTech app?

The average cost of developing a FinTech product may vary from $50,000 to $300,000. However, the exact figure depends on your project complexity and a broad range of various factors. The final cost is usually agreed upon after the team estimation as per your brief or technical task and another requirement.

Fintech development perils

Since FinTech, by definition, is a very broad term used to describe any technology that aids financial transactions and there may be lots or any of them chosen to be used in your project, there may also be development risks related. Here are some of the most solid:

Market

The finance sector is known to be one of the most legally regulated sectors. Even when using FinTech software, the government has the right to intervene. that is why the companies face threats from cybercriminals when security protocols are not up to date and financial sanctions from regulators, etc. Government agencies set standards and rule-based criteria for organizations to protect themselves from compromise and disclosure of their users’ personal information.

That’s why to protect yourself from fines and sanctions from the state, before creating software; you need to check it for compliance with the law.

Data Security

Data security and privacy protection should always be a top priority in any FinTech company to properly protect the data of organizations and private customers. In addition, every FinTech company, regardless of size, has a strong responsibility to do what is necessary to protect the entire infrastructure of the financial services industry.

Adopting these security measures is incredibly important as many business transactions take place within an interconnected global communications enterprise, which increases overall vulnerability. You need to comply with the GDPR and PCI regulations. And to protect all your users’ data.

Compliance

The financial sector is one of the most legally regulated sectors. Even when using FinTech software, the government has the right to intervene. Companies face threats from cybercriminals when security protocols are not up to date and financial sanctions from regulators, etc. Government agencies set standards and rule-based criteria for organizations to protect themselves from compromise and disclosure of their users’ personal information.

That’s why to protect yourself from fines and sanctions from the state, before creating software; you need to check it for compliance with the law.

Final Words

The FinTech industry is a specific area that requires incredible precision and security in all operations. And digitalization helps to achieve this. In addition, companies use financial solution software to improve employee productivity, customer satisfaction, and overall business performance. Thus, a reliable developer must build an app or develop an effective website.

Correctly selected FinTech development services will make life easier for all parties to interact and automatically complete most of the tasks. Our team is ready to offer you web development in FinTech and the implementation of any technology in your startup or existing project. Just feel free to hire us.